And here we are, just past half-way through 2019! Happened so quick, I’ll bet you feel a bit of whiplash. It’s been an interesting half-year so far, especially when it comes to the Monterey and San Francisco Bay Area real estate market. For this 2019 Mid-Year Real Estate update, I took a dive through the MLS (Multiple Listing Service) to dig deep through the numbers for Santa Cruz, Santa Clara, and Monterey counties for the first six months of the year.

So how is our real estate market doing, at the mid-point of 2019? One that comes through loud and clear is that just like politics, all real estate is local. The story told through these numbers is much different in all three counties. If you want, you can skip down to the county that interests you most: Santa Clara, Santa Cruz, or Monterey.

Seb Frey Talks Real Estate Mid-2019 on Seb Frey TV

Santa Clara County

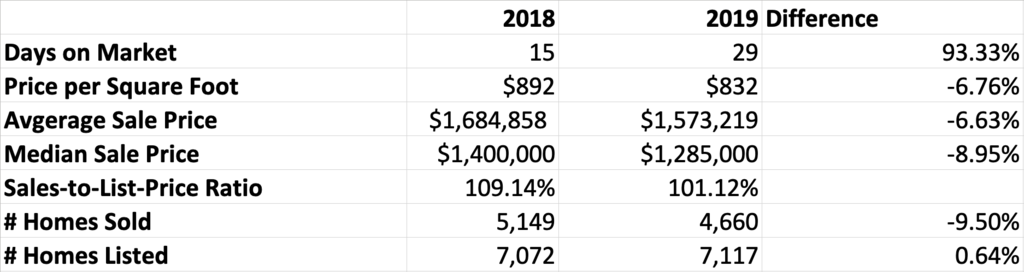

Santa Clara County is the heart of Silicon Valley – what happens there affects the real estate market for a large portion of northern California, and all of the San Francisco and Monterey Bay Areas. The numbers for the first half of 2019 are markedly different than the first half of 2018. In particular:

- Homes are taking almost twice as long to sell this year (93% longer)

- Price Per Square Foot has dropped 6.76%

- Average Sale Price has dropped 6.63%

- Median Home Price has dropped 8.95%

- Sale to List Price Ratio down 8%

- Home Sales are down 9.5% this year vs. last year

- The number of homes hitting the market is up less than 1% vs. a year ago

This is the first time Santa Clara county has seen a softening of the market like this since the end of the great recession. The question is: why? Interest rates are near historic lows, employment is higher than ever, wage growth is better than it has been in many years. Tech giants are expanding (think Google and Apple’s massive expansions into San Jose), the stock market is at or near record highs, and course there’s a string of local tech IPOs going on or in the wings – Lyft, Uber, AirBNB, Slack, Pinterest, and others.

Nobody knows exactly why home prices have softened even in the face of what is by all accounts a roaring economy – but I have some ideas. Primarily, I believe that when prices are galloping up 10-20% a year, home buyers are much less cautious and will compete against other buyers for the home they want. However, prices cannot rise 10-20% each year forever, and consumer sentiment is that we have reached some kind of pricing plateau. Buyers are pulling their punches when shopping for homes, playing chicken with the market. And for now, buyers are winning.

Also, while tech employment is strong and growing, many of these techies are actually foreign contract workers who are not sharing in the cash bonanza to a large degree. Many of them are on temporary visas, and may not end up staying around long enough to put down roots and buy property. The actual number of employees who have vested stock options and gargantuan incomes is finite and smaller than is generally understood. There are only so many people who can come up with a $400,000 down payment and/or can afford a $6,000/month housing payment. It seems that in Santa Clara county, we may have exhausted the ready supply of such buyers.

It may also be that would-be home owners are coming to terms with the new tax structure put in place with President Trump’s tax reform that went into effect in 2018. The tax incentives for owning more expensive homes in Silicon Valley have largely disappeared, and we may be seeing the the implosion of the move-up market because of it.

Santa Cruz County

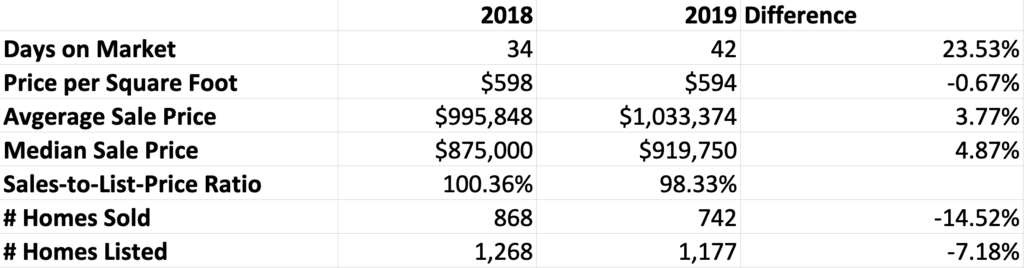

Interestingly, they’re playing a different tune in Santa Cruz. The Santa Cruz market in comparison to Santa Clara seems relatively stable:

- Days on Market up just 23.5%

- Price per Square Foot down just 0.67%

- Average Sale Price is up 3.77%

- Median Sale Price is up 4.87%

- Sale to List Price Ratio down 2%

- Homes Sold Down 14.52%

- Homes Listed down 7.18%

In Santa Cruz, homes are taking just 8 days longer to sell this year compared to last year. It seems that the homes selling this year are larger than last year – the price per square foot is down a fraction of one percent, but the median and average sale prices are up by a comfortable margin – comfortable for buyers, and for sellers as well.

Why have home prices in Santa Cruz not dropped like they have in Santa Clara county? To that, I say: give it time. I believe that if prices in Santa Clara county continue their downward trajectory, prices in Santa Cruz will drop as well. For the past several years, as Santa Clara county prices have ballooned, many would-be Santa Clara county buyers have decided they’d rather have cleaner air, much lovelier landscapes, beaches, forests, and generally-better schools in Santa Cruz, at much lower prices – the only trade-off being a longer commute.

But time is precious; everyone has that in limited supply. Even though Santa Cruz county is by many metrics a much nicer place to live, the commute time to Santa Clara county is what will keep home shoppes looking there first, if money is less of an object. If prices in Santa Clara county continue to slip, I believe it is inevitable that prices in Santa Cruz county will follow suit.

Monterey County

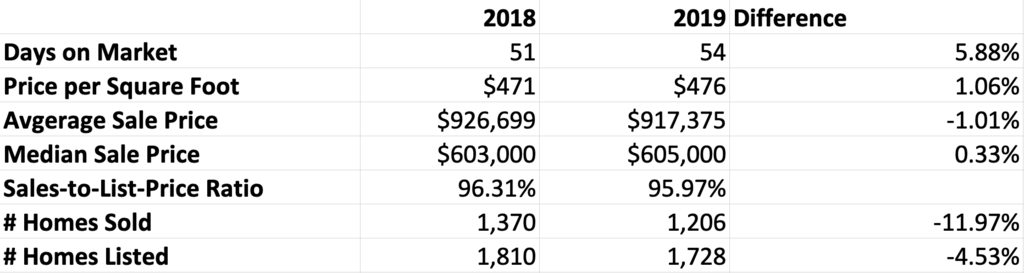

Monterey County is less strongly influenced by Santa Clara county than is Santa Cruz – but what happens in Santa Clara county matters in Monterey. What we’ve been seeing is that as locals get priced out of Santa Cruz, they move down the coast to Seaside, Marina, Salinas, and Monterey – which is where almost everyone in Monterey County actually lives. The changes in the Monterey county market in 2019 vs. 2018 have been much less noteworthy:

- Days on Market up only 5.9%

- Price Per Square Foot up 1%

- Average Sale Price down 1%

- Median Sale Price up 0.33%

- Sale to List Price Ratio virtually unchanged

- Number of Homes Sold down 12%

- Number of Homes Listed down 4.5%

Monterey County is like an ocean of calm compared to Santa Cruz, and especially to Santa Clara. It’s also easy to see that in the long run, Monterey prices have a long way to rise, being over 50% less than Santa Clara county and about 33% less expensive than Santa Cruz.

But that’s over a longer term. In the next 1-3 years, if home prices in Santa Clara county continue to drift downward, fewer buyers will be pushed into more-affordable Monterey County – which will have the effect of making Monterey county more-affordable still.

Is the party over?

The story told by the market data for the first half of 2019 is a much different one than we’ve been seeing for the past 8+ years, when the recovery from the great recession began in earnest. But does this mean that it’s all down hill from here?

Current economic conditions do not herald a coming collapse of the real estate market. On the other hand, on the surface they don’t indicate that prices should be dropping, even a little. The truth is, there are simply too many variables to isolate the precise, unimpeachable reason(s) for the pull back in the market.

It very well could be that we have reached the fabled “soft landing” with home prices that economists are always opining about. It sure feels like it, with “soft” being the operative word here. However, I would point to the staggering number of world-beating enterprises in the greater San Francisco Bay Area and long-term growth trends as reasons to feel secure in a sizable real estate investment in the greater Bay Area. There are always peaks and valleys over time with any market – and once in a while, you’ll hit a plateau as well.

I don’t think the party’s over, but it’s clear the band is taking a break. It remains to be seen what kind of tune they’ll be singing when they start up again