Automated Valuation Models, popularly known as AVMs, are increasingly becoming a go-to tool in the real estate sector. Their ability to provide quick, cost-effective, and objective property valuations has revolutionized the way real estate and mortgage professionals and individuals assess the worth of a property in Silicon Valley. This article will explore the various automated valuation models used in Silicon Valley so buyers and sellers can identify them and the role they play in the purchase and sale of Silicon Valley real estate.

What is an Automated Valuation Model (AVM)?

An Automated Valuation Model is a software-based pricing model utilized predominantly in the real estate and mortgage industries to estimate property values. This machine-learning model harnesses numerous data points to establish the estimated property value. The data analyzed often includes property characteristics, comparative sale prices, property market trends, the age of the property, among other factors.

There are many automated valuation models used throughout the country, and none are specific to Silicon Valley. These models are “black boxes” – the inputs they use to determine the estimated home value are unknown to anyone outside the companies that produce the models. All of these models are proprietary; there are no “open source” automated valuation models available that I am presently aware of.

How do AVMs work?

AVMs utilize proprietary algorithms to sift through vast amounts of property and local market data, generating an estimated property value. Actually, three values are typically given: low, mid, and high values with the “mid” value being the one that is typically stated as being “the” estimated value. They assess various factors, such as the square footage of the home, the year it was constructed, the number of bedrooms and bathrooms, lot size, recent sales of comparable properties, and local market trends. They may incorporate other factors as well. such as the prior sale price of the property, but again, these AVMs are “black boxes” and we cannot see inside to know for sure how each one functions.

AVMs are driven by technology, including proprietary algorithms, and their reports can be obtained in seconds by lenders, real estate agents, and in many cases to the general public through real estate websites. They usually contain both a hedonic pricing model (a type of statistical regression analysis) and a repeat sales index, which are both analyzed to generate the price estimate.

When AVMs Work Best

Automated Valuation Models do their best work with recently-built large real estate projects. These includes tract homes in subdivisions, townhouse developments, and large condominium complexes. It is fairly easy for anyone – especially a computer – to estimate a resale price when there are hundreds (or perhaps thousands) of homes in a tight geographic area, that were all built within a small span of years, of similar square footage, on similar-sized lots, with similar finishes and even built by the same builder. There just aren’t that many variables to account for with these kinds of properties, and there are also few unknown variables which can effect the value of a home. For these kinds of properties in Silicon Valley, these kinds of pricing models can produce fairly accurate estimates.

Where AVMs don’t Work Well

AVMs do not do very well with homes which aren’t so “cookie cutter” – and that describes many homes in Silicon Valley. While there are of course untold tens of thousands of tract homes in Silicon Valley, most of them are older. Over the decades that they’ve stood, these homes have undergone changes – some changes for the better, some for the worse. Some homes are more or less original, others have been completely transformed and updated. Some homes have not been maintained at all in 50 or 60 years, others have been very well maintained but maintain essentially the same look and feel as they did when they were constructed in the 1970s. It is impossible for an automated valuation model to know about these often considerable differences between homes which, on paper, appear quite similar but in reality are markedly different, and will be valued quite differently in the actual real estate marketplace.

And then there are the houses on the outskirts of town. While most homes in Silicon Valley are on typical suburban American streets, there are many built in the hills. These are often custom homes with bespoke amenities. Some will have amazing views, some will have plenty of flat, usable land while others will have steep parcels with little utility and no views. Some will have high-quality roads leading to them; others will have poorly maintained winding roads that deter buyers from ever going to see them in the first place.

It can be challenging for an experienced appraiser to put an accurate number on homes like these. It is much more challenging for an automated valuation model to do so, because they cannot be aware of most of these peculiarities to begin with.

AVMs vs. Home Appraisals

While both AVMs and home appraisals aim to provide a valuation of a property, there are significant differences between the two techniques. AVMs leverage technology to produce a fast, on-demand estimate based on data analysis. In contrast, home appraisals are carried out by licensed professionals who physically inspect the property and consider various tangible and intangible factors that AVMs couldn’t possibly account for.

Pros and Cons of Automated Valuation Models (AVMs) in Real Estate

Like any tool, AVMs come with their own set of advantages and limitations. Their primary benefits include their speed, cost-effectiveness, and objectivity. They offer an efficient way of calculating property values, saving time and money in the process. However, their accuracy depends highly on the quality, quantity, and relevance of the data they analyze.

Sometimes, an AVM will turn out to be surprisingly accurate. However, you know what they say: even a broken clock is right twice per day. No AVM can or should be relied on to provide a solid estimate of any home’s value. I will grant you that an AVM estimate is better than no estimate, as it will at least give you a starting point to consider a home’s value.

Notable Automated Valuation Models used in Silicon Valley

Several AVM providers have carved out a niche in the real estate sector, offering varying degrees of accuracy based on their proprietary algorithms and data sources. Let’s take a look at several of the publicly available AVMs, and how they performed evaluating one specific property – a listing I sold in Saratoga a few years back.

Zillow’s Zestimate

Zillow’s Zestimate is the best-known and most popular AVM. However, since it often relies to some degree on user-submitted data, its accuracy can be compromised if the data provided is incorrect or incomplete. Zillow also claims that its AVM analyzes the photos for the properties to consider the condition and amenities a property offers to aid in its estimates, which is perhaps unique among automated valuation models.

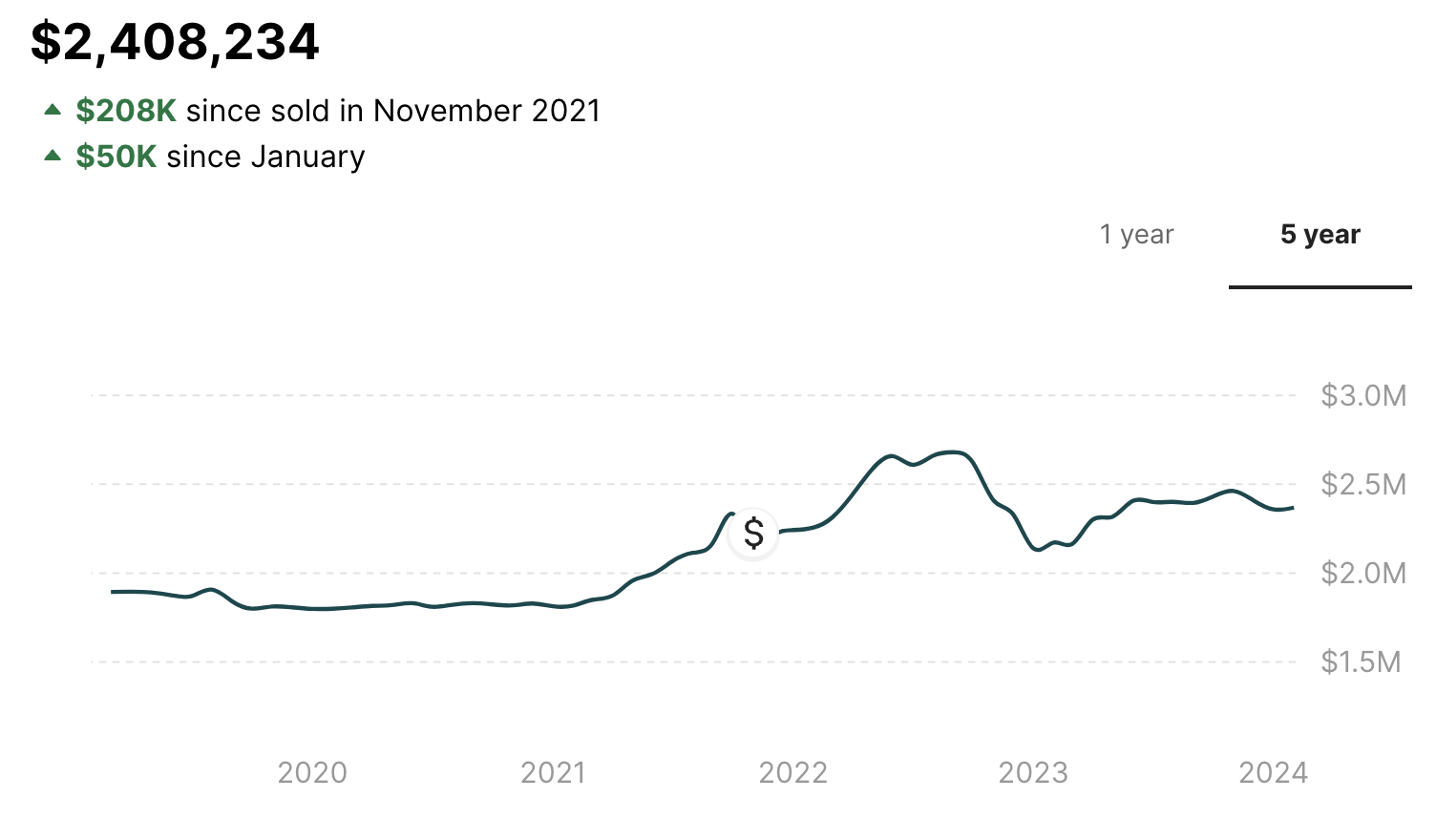

At the time of this writing, the Zillow Zestimate for my example home in Saratoga is $2,341,600, and Zillow provides a nice chart showing how it estimates the value has gone up and down over the past 5 years (or 1 year, or 10 years):

While many consumers appear to put great faith in the Zillow Zestimate, it is rarely 100% accurate. Zillow publishes information on the accuracy of its Zestimate. It doesn’t provide this data for Silicon Valley, but it does break out the numbers for San Francisco, which as of this writing are:

- Median Error Rate: 3.11%

- Within 5% of Sale Price: 67.07%

- Within 10% of Sale Price: 87.46%

- Within 20% of Sale Price: 97.62%

Redfin’s AVM

Zillow has some strong competition in the AVM space from Redfin – this is the second-most-cited automated valuation tool in my experience. Redfin will give you a single value estimate, but it will also provide a range. In the case of my example sale in Saratoga, the Redfin Estimate is $2,408,234 – but at the low end it says the price could be $2,290,000 (-4.9%) or up to $2,720,000 (+12.9%). That’s quite a wide range of possible prices, and it would be difficult for a consumer to make any decisions with such a wide range of values.

Realtor.com’s AVM

Realtor.com’s does not really have an AVM, rather it provides data from several leading AVM providers, allowing users to view a range of price estimates for a particular property. This is a neat feature of Realtor.com although it can be confusing, as quite often there is a large discrepancy between the values given by the different providers. Looking at the page for my example sale in Saratoga, here is what we see for the estimates as of this writing:

It’s interesting to see that Collateral Analytics gives an estimated value that is wildly higher than the others – over $1,000,000 higher in fact. But Quantarium gives value that is over $200K higher than CoreLogic, and also more than $200K higher than Zillow.

ComeHome.com’s AVM

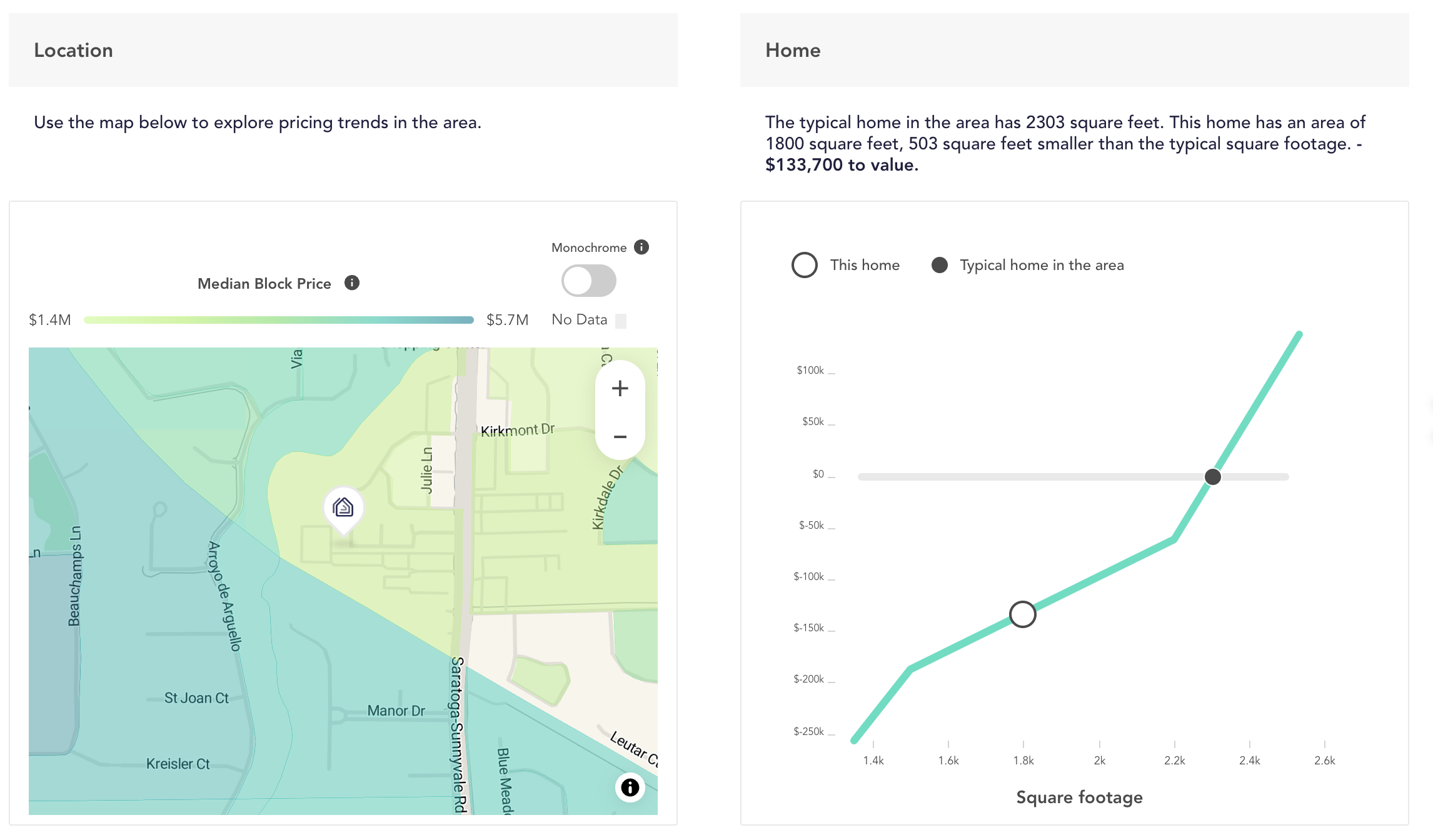

An increasingly popular tool available to the public is ComeHome.com. Check out what they have to say about my example sale in Saratoga:

What’s cool about ComeHome.com is that they provide a “deep dive” into the homes and provide some additional information and insights into the value that other platforms won’t give you, such as the median block price, and how much increase or decrease in value they attribute to the difference in square footage.

Other Automated Valuation Model Tools

CoreLogic Total Home Valuex

CoreLogic’s Total Home Valuex combines artificial intelligence, cloud technology, and machine-learning-powered analytics to offer accurate property value estimates. Most of its data comes from public record data collected from government officials and county clerks. A number of platforms use data from this CoreLogic tool, however the tool itself is not publicly available for use by consumers. However, my own home value estimator does use this tool.

ATTOM’s AVM

ATTOM’s AVM is powered by a nationwide residential property and sales database. It offers property valuations on over 84 million homes across the U.S., covering 98% of the American population. Their AVM is not publicly available, but rather is incorporated into third party tools – and as it happens, my automated home value estimator uses ATTOM’s AVM as well.

The Bottom Line

AVMs are a powerful tool for quickly and cost-effectively estimating property values. However, they should not be solely relied upon for a final valuation, particularly when it comes to high-stakes transactions like buying or selling a home. AVMs are most effective when used in conjunction with other valuation methods, such as professional appraisals or comparative market analysis (CMA) carried out by a Silicon Valley real estate professional like myself.

In conclusion, while AVMs have their limitations, they are an invaluable tool for anyone involved in real estate. By understanding how they work and how to interpret their results, you can make more informed decisions about property values.

San Jose Luxury Homes For Sale

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25