Real estate values in the Golden State have been soaring for the past couple of years – especially around the San Francisco bay area. Of course, high-priced real estate is nothing new around here. In fact, it’s almost as though someone’s been planning for high cost real estate for years! But the dramatic price increases we’ve seen recently have again brought the high cost of housing in the bay area into sharp focus.

One striking characteristic of the bay area real estate market in the past couple of years has been low inventory. In most of the region, there’s been far less than a six month supply of homes, which is what is considered a “balanced” market. In some neighborhoods, supply has been as low as six weeks – or less. Conventional wisdom dictates that when prices rise, supply will open up to meet that demand. Yet in the face of steadily rising prices, that supply has yet to appear. Many market watchers are wondering, when and how will that change?

The possibility exists that we are now entering a new normal: a perpetually low supply of available homes. Faced with a growing population and a booming tech sector, this could well mean that we’ll see home prices continue to climb into the stratosphere – out of reach of the vast majority of the folks who make the area their home. Only the very well-heeled will be able to afford to buy property within a reasonable commute distance of the area’s major employers.

Is this dystopian view of the future the only possible outcome? What could be done to make residential real estate more affordable for the 95% of people who don’t earn well into the six figures? What indeed?

Apple Campus 2

The other day I was in Cupertino, and I thought I’d drive by the new Apple Campus. This is a mammoth project, estimated to cost around $5 billion. It sits on 175 acres of land, and when complete will comprise approximately 2.8 million feet of of work space, and host 13,000 employees. It’s a strong commitment by Apple to Cupertino, and the Bay Area and California in general.

And what’s directly across the street from this amazing new high-tech work place of the future? Single family homes built in the 1950’s and 1960’s on 6,000+ square foot lots. These homes range in size between about 1,200 and 1,700 square feet, and start at about $1 million. For a tear down.

Now, you would think that given the intensive use of the new Apple Campus that there might be some new residential development going on. Some new townhouses, or perhaps some multi-story condo projects such as you’d find in big cities almost anywhere in the world. If you thought that – you’d be half-right. There is some of that going on – but not anywhere near the new Apple Campus that I can see, and certainly not in sufficient quantity to meet anything close to demand.

And why is that?

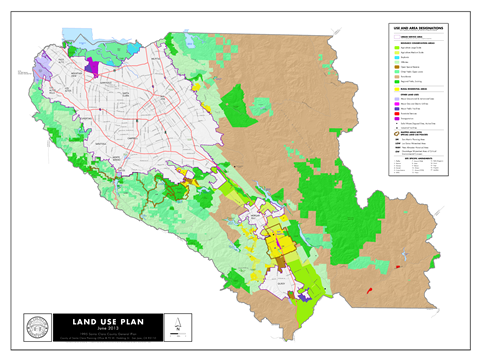

In a nutshell: planning and zoning. The cities of Cupertino and Sunnyvale have not updated their zoning rules to permit higher density housing. And that’s true in most places in the Bay Area and the surrounding counties. The zoning which is in place was designed for a low-density, suburban, automobile-based lifestyle. With the exception of San Francisco, virtually the entire Bay Area has been planned and built for a bygone era.

Cities and counties in northern California work assiduously to keep population density low, usually permitting only the slowest of growth. This is achieved through the strict enforcement of planning and zoning regulations. For the most part, these zoning regulations enjoy broad popular support. If you paid $1.5 million for one of these 1950’s ranch houses on your 6,000 square foot lot, would you want to see the other ranch houses nearby torn down and a mid-level apartment block go in down the street? I’m guessing not.

You know what they say: real estate is a great investment because they’re not making more of it. Actually, that’s not exactly true. They’re making more of it in Dubai, where they are building artificial islands in the gulf. They’ve done it all throughout San Francisco’s history, where the bay has been continually filled in to create more real estate. While that kind of development is no longer viewed favorably in northern California, there are other ways of creating more real estate: by subdividing what currently exists into smaller parcels.

So what’s stopping us? Again: planning and zoning. Minimum parcel sizes, for example, combined with rules for the “usability” of the land (subtracting out steep terrain, easements, setbacks, and the like) and fire safety restrictions (multiple methods of egress) work together to make it virtually impossible to split most parcels in the majority of suburban Bay area counties. If parcels could be more easily split, more single-family homes would be built, increasing population density. But that doesn’t happen much.

As an alternative to splitting a parcel, many home owners would like to build an accessory dwelling unit – a guest house, or granny unit. Again, planning and zoning comes into play here, as there are many rules regarding minimum lot sizes to support a granny unit, parking restrictions, setbacks, lot coverage ratios, and the like.

Tug of War between competing land use interests

There’s a quiet tug-of-war going on, between those who favor higher density development, or re-development, and those who prefer to keep things just the way they are – and the rope in the game are the planning and zoning regulations and land use policies of the various governments. For now, it appears that NIMBY-ism is prevailing, and the growth of the housing stock will continue to lag demand for the foreseeable future.

That goes a long way to explaining why real estate is so expensive in California’s Bay Area, and why it’s so cheap in, say, Texas. In Texas, planning and zoning regulations are weak or non-existent. New subdivisions are built willy-nilly, with no end in sight. There is effectively an unlimited supply of real estate there, and prices are low accordingly.

This is why people in Texas do not generally buy real estate with an eye toward an appreciation in value. However, given California’s markedly different regulatory climate, and the deep and widespread sentiment that urban sprawl and high density are undesirable, it is easy to see why real estate prices continue to rise over time, in particular during boom times such as Silicon Valley currently enjoys.