Winter – such as it was – is now squarely in the rear-view mirror and spring is in full bloom in Santa Cruz. It looks like the rains – such as they were – are now behind us and it’s nothing but blue skies from now on. But can the same thing be said for the Santa Cruz real estate market? Let’s dig in to the numbers.

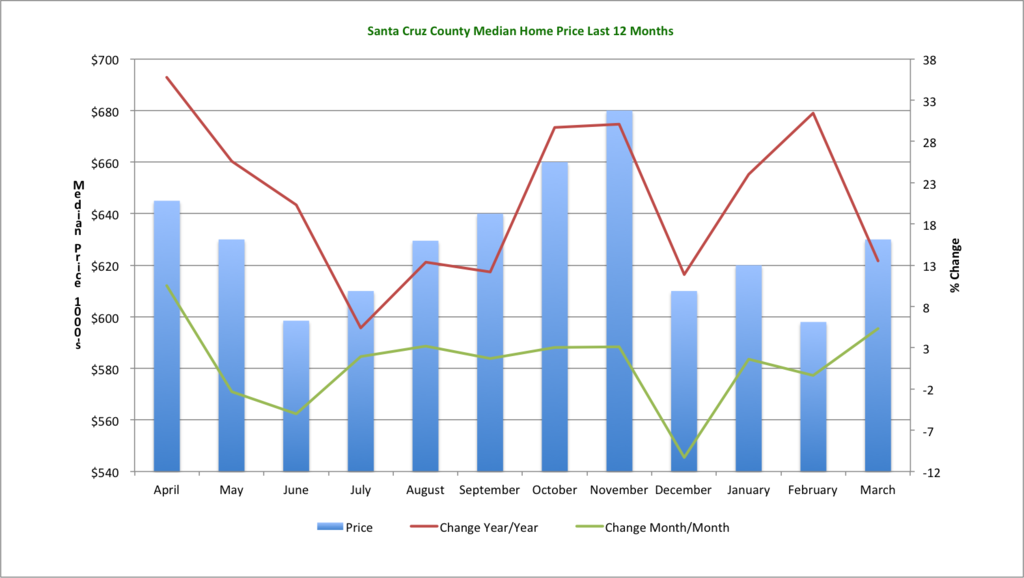

The median home price in March 2014 for single-family homes was $630,000 – that’s up a healthy 13.5% compared to a year ago (when the median price was $555,000) and up 5.4% compared to the month prior. Keen readers of this newsletter may note that the month-ago and year-ago numbers reported here differ from when those same numbers were reported as a month and a year ago – as will sometimes happens as errors are corrected or missing data is added.

While the median price was up month over month, the sales volume was flat compared to last month. Last month, 123 homes closed escrow; this month, 122 homes closed escrow…however this compares to 183 closings a year ago, for a year-over-year decrease in volume of 33.3%. It looks to have been a lean winter for the real estate, mortgage, and title/escrow business!

Inventory also increased modestly compared to a month ago: we closed out March with 357 homes available for sale county-wide, up 2.3% compared to a month ago, but still considerably lower (15.8%) than a March 2013 when 424 homes were available at the end of the month.

Although the sales volume decreased and inventory increased, the sales-to-list-price ratio went up to 99.4% – compared to 98.3% the month before in February. A year ago, however, the sales-to-list-price-ratio came in at an impressive 100.5%.

One factor which I really feel drives real estate values is the days of inventory – that is, given how many home are available, and how many homes sell per month, how many days left of inventory are on the market, assuming no new homes come on the market? We closed out the month with 88 days of inventory – which means we are still very much in a seller’s market. A market which is “balanced” between supply and demand will have about 180 days worth of inventory – and presently there’s just about half that available. However, the days of inventory today is greater than both a month ago (when it was 77) and a year ago (when it was 69). What does that mean as regards Santa Cruz home prices? Well, check out this chart:

Ahh, the ol’ Santa Cruz Absorption Ratio vs. Price chart. That old chestnut. I love this chart – I made it myself! The pink bars represent how fast the market is absorbing inventory – the shorter the bar, the faster inventory is gobbled up. The green line is the median home price. Notice the trend? When the pink bars grow longer (that is, inventory is not being sold as rapidly), the median price tends to drop. When the pink bars get shorter – and they have been pretty short now since April 2012 – the green line goes up, and up.

Right now, the absorption rate is still very favorable for sellers. But if you look at it closely, you’ll see that the pink bars are creeping up from the low that was set in March 2013, a year ago. The absorption ratio on the chart is presently at 2.96. What will happen though when the absorption ratio hits, say, 5.48 again like it was in November 2011, and the median price was $417,500? What then?

What’s YOUR home worth in today’s market?

Home prices have risen steadily in this year – how much is YOUR home worth in today’s hot market? Find out now with this free, quick, and accurate tool!

What then indeed! Obviously the correlation between absorption ratio and median price is a little loose, they don’t go forward in lock-step, and there are many other factors around such as interest rates, unemployment rates, income levels, affordability, and so on. And of course, this chart only goes back to July 2009 which is about the time the California housing market is generally thought to have hit bottom. But I would wager that if we hit an absorption ratio again of 5.48 in the next couple of years, the median price will be lower than it is today. Anyone want to take me up on that?

It’s not a question of if, but when, the supply of homes compared to demand increases and comes more into balance and eventually tips in to a buyer’s market. The open question is, what will that mean to Santa Cruz home prices? And, when will that happen?

The answer to the second part is clear: it’s already happening. Those pink bars have been going up, gradually, for the last year. I think that’s why we have seen that the median home price – while up compared to March a year ago – is really a bit lower than it was in April a year ago. It looks to me as though prices have begun to moderate, and I’m going to go out on a limb here and say I don’t think we will see prices hit last year’s November peak of $680K again for a while, given how inventory is slowly building.

There’s whispers and rumblings in the market of another real estate bubble forming in California. Are we seeing a bubble here in Santa Cruz? If it is, I think it’s more like a bulge than a bubble. The real estate market has radically transformed since the bubble burst in 2007/2008. A lot of weak owners have been flushed out of the system – many homes these days were purchased for cash, and many more were purchased with a full 20% down. Comparatively few people today are buying with low-down loans, and almost nobody is purchasing with 100% borrowed money. Back in ’07 and ’08 when the wheels really fell off the wagon, many home owners had virtually none of their own money into the houses they owned, and walking away when they were plunged deep underwater was almost a no-brainer. For many homeowners today, it’s a radically different equation.

I don’t expect to see prices take a dive in the near future. That’s maybe bad news for buyers who are thinking the market has become over-inflated. In a way, it may be a consolation: yes, it probably would have been better if you’d bought in 2010, but it’s not likely to be a disaster for you if you buy in 2014.

It’s also maybe bad news for sellers. A lot of sellers I think are still thinking that the market is going to keep on rising. And it may, and probably will, over the long term. But what’s going to happen over the next 2-3 years? I’m thinking the market is going to pretty much sit still. In the meanwhile, let’s enjoy the ride as best we can.

As always, to get the full, PDF version of my newsletter, broken down by different areas of the county and also by Single Family Residences as well as Condominiums, click here to download the full the Santa Cruz Real Estate Market Trends newsletter.

Please share my newsletter with anyone you think is interested in what’s going on with the Santa Cruz real estate market – just send them the link and they can sign up to receive an e-mail every month when the newsletter is ready. Thanks so much for taking the time to read this – I hope to hear from you soon!