Shhhhhh! The Santa Cruz real estate market is sleeping – or it was in November anyway, and it looks like December is going to be pretty sleepy as well. It seems the market is taking a nap after a very vigorous month in October. Read all about it in this Santa Cruz Real Estate Update – December 2014 edition.

The median price for single-family homes in Santa Cruz county in November 2014 was $685,250 – a bare 1.5% increase from the median price a year ago. It also represents a decrease of 4.7% from the median price last month. Sales volume though was really low – just 120 homes closed escrow in November, a decrease of 11.1% from a year ago, and down 30.2% from the previous month. Next month we’ll be looking at even fewer closings, as we finished November with just 83 homes pending sale in Santa Cruz county.

On average, sellers received 98.8% of full asking price for their homes – that’s slightly better than a year ago, when homes sold for 98.4% of asking price, but not so good as in October of this year, when homes sold for 99% of asking price. The homes that sold did so in an average of 48 days, which is pretty similar to the 49 days it took a year ago.

The interesting thing to look at this month is the ongoing saga of low inventory. Inventory got a whole lot lower in December, dropping nearly 12% in November compared to the month before, and down almost 29% compared to a year ago.

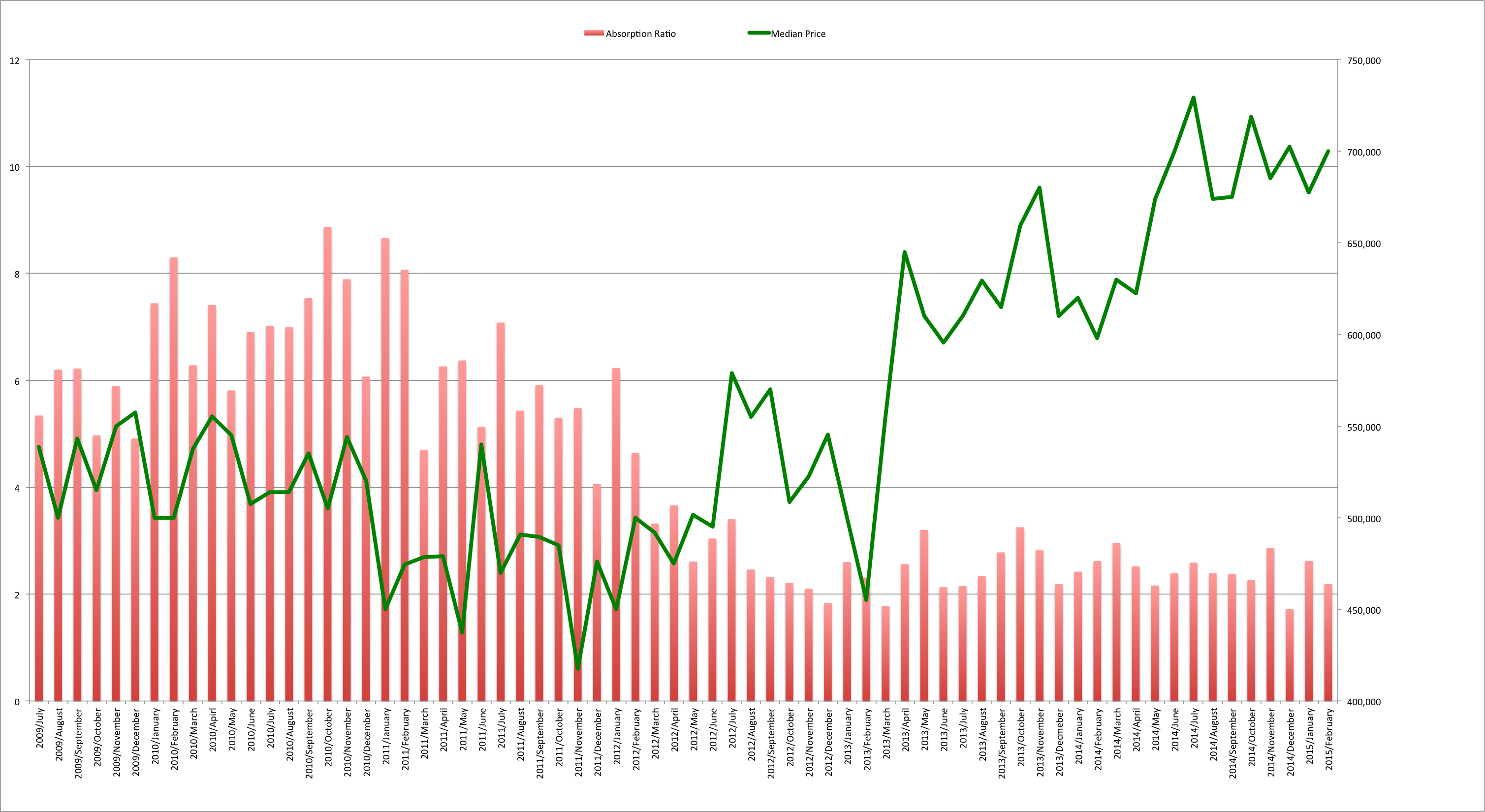

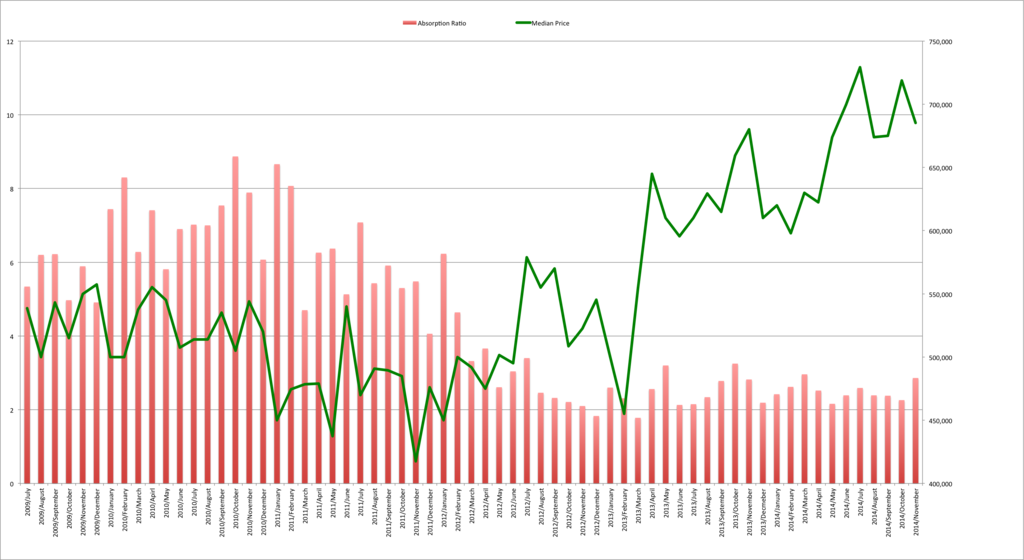

The fact that inventory dropped in November doesn’t really mean much until it’s put in the context of demand. With just 120 homes having sold in November – and closing out the month with just 83 pending home sales – we can see that actually the market is not absorbing the available inventory as quickly as it has been doing for most of the year. Check out the price vs. absorption ratio chart below:

To see the chart a bit better, you can click on it and the chart will load up in its own window. If you will do, you will see that the absorption ratio bar grew considerably in November – which points to lower prices. And that’s exactly what we got in November, with a lower price month-over-month, and a very slim rise over the price a year ago.

The last time we had an absorption ratio like this was in March of 2014, which coincidentally enough was the low point of home prices in 2014…but just after that, prices took off like a rocket and climbed throughout the spring and summer.

The question is, will this happen again as we head into 2015? Looking at the chart, it’s pretty clear what happens to home prices when there’s lower demand relative to supply: prices tend to go down. If this trend keeps up, the data show that prices will in fact be headed down. However, there are some macro trends at work which seem to indicate that 2015 is going to be another strong year for real estate.

Specifically, the U.S. jobs report for November was surprisingly strong, with 321,000 jobs having been added. In fact, 2014 has been the best year for job gains since 1999. And, crucially, wage growth picked up, with hourly earnings up by 0.4% in the month – and up 2.1% for the year (slightly exceeding the rate of inflation). The wage growth number isn’t amazing, but it’s a positive trend in the right direction. Not only that, but payroll numbers were adjusted upward by 44,000 for both September and October, for an average increase in jobs of 278,000 over the past three months.

When the economy starts to heat up, and there’s an increase in demand for money, the natural effect is for interest rates to rise. Indeed, an increase in mortgage interest rates has been predicted by just about everyone…but that has so far failed to materialize. In fact, today, long-term mortgage interest rates are the lowest they have been since May 2013, with a 30-year fixed interest rate mortgage now at an average of 3.89%. Low interest rates like this will work to bolster home prices, as cheap money makes higher prices more affordable for borrowers.

So why are interest rates so low, given the fact that the economy is gathering steam? A lot of folks point out the fact that the U.S. Dollar is gaining strength, as foreign investors pour money into the United States. While our economic growth rate isn’t exactly eye-popping, we’re doing considerably better than, say, Europe, where the economy has expanded by just 0.2% in the second quarter of 2014.

But the U.S. employment rate, GDP growth, and mortgage interest rates are all national numbers – and real estate is a local business. Locally, the Silicon Valley is humming right along. For example, a real estate investment company has just made a $3.5 billion deal to buy more than 25 office buildings in Silicon Valley – a big bet on the strength of the area economy in the coming years.

According to Zillow, the median home price in Santa Clara county today is $830,000 – which makes Santa Cruz county look like a relative bargain. Once again, many folks with good paying jobs in Silicon Valley are looking to Santa Cruz as an affordable housing market, and this is the single biggest factor bolstering the local market.

Please share my newsletter with anyone you think is interested in what’s going on with the Santa Cruz real estate market – just send them the link and they can sign up to receive an e-mail every month when the newsletter is ready. Thanks so much for taking the time to read this – I hope to hear from you soon!