At long last, the moment you’ve all been waiting for – the Santa Cruz Real Estate Update December 2015 is here! The days are short and the nights are long and cold – but don’t tell that to the Santa Cruz real estate market! It’s still warm and toasty as we close out the year, and all signs point to a robust market in 2016.

We wrapped up November with a median single-family home price of $703,750 – up a scant 2.7% from this time a year ago, when the median home price was $685,250. There was a total of 128 single family homes sold, county-wide last month – marginally better than a year ago, when we sold 126 homes in this same period.

These 128 homes sold in an average of 55 days, and for an average of 97.5% of full asking price. That’s a lower sales-to-list-price ratio than we’ve seen for much of this year, but not bad for autumn, and slightly better than last year, when the ratio was 97.3% at this time.

Right now there are just 459 single family homes listed for sale on the Santa Cruz MLS, but of those, 203 are presently under contract to be sold, leaving just 256 homes available for purchase anywhere in the county. The way I figure it, that comes out to a 56 day supply of inventory – just under two months! If you’re looking to buy a home in Santa Cruz county, the cupboard is looking pretty bare.

Given what’s going on with prices, a lot of buyers are looking for deals – like short sales and bank-owned REO foreclosures, aka “distressed” sales. But distressed sales are yesterday’s news: of the 128 homes that closed escrow last month, only two were bank-owned REOs – that’s 1.5% of sales – and exactly zero were short sales. For the year through November 30th, a total of 39 REOs were sold, and 32 short sales. That’s just 71 distressed sales, out of a total of 1,855 total closed sales – representing barely 3.8% of all sales of single family homes.

If you’re looking to find a deal on a home in Santa Cruz, I’d recommend not focusing too much on foreclosures or pre-foreclosures (“short sales”) at this time – you’ll end up waiting an awfully long time for a home that may never show up. “Bargain” properties are in extremely short supply. But remember this: fantastic deals are made, not found. If you want to get an amazing deal on a home in Santa Cruz, know that you’ll have to roll up your sleeves and make it happen.

So what’s in the cards for real estate next year? Speculation is especially rampant this year, as the Federal Reserve Board just increased the federal funds rate for the first time in nearly a decade. What will this 0.25% increase in the federal funds rate mean for the U.S. economy, and for mortgage rates in particular?

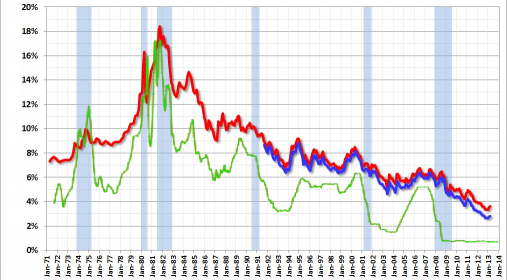

Many people think that an increase in the federal funds rate automatically translates into an increase in mortgage rates – but that is not the case. While consumer interest rates tend to rise in response to an increase in the federal funds rate, it is by no means automatic or proportional. Actually, mortgage rates have already risen a bit in anticipation that the fed is going to raise rates – so when the rate actually does raise, there may be no change in mortgage interest rates at all. Check out this chart below:

Mortgage Rates vs. Federal Funds Rate

The green line shows the federal funds rate. The red line is the 30 year mortgage rate, and the blue line is the 15 year mortgage rate. As you can see, they follow a similar pattern but are not identical.

A big worry among many prospective home sellers is that an increase in mortgage rates will lead to a decrease in home prices, because the cost of borrowed money will be higher. These fears are overblown. The Federal Reserve has taken its sweet time to raise interest rates, and have only done so because the U.S. economy has strengthened enough to support a higher rate.

One of two big numbers to look at is the unemployment rate, which last month hit 5%, which is a pretty respectable number. There are a lot more Americans working today than there were three years ago when home prices started rising sharply.

Perhaps a more important number though is wage growth. Increase in consumer wages have been hard to find since the onset of the great recession. However, a new study of the California economy says that real personal income growth (after inflation) is estimated at 4.3% for 2015, 3.,4% for 2016, and 3.2% for 2017. Another study showed that “high tech” workers in San Francisco enjoyed wage growth of 12.8% in 2015, and those in Santa Clara county saw growth of 8.4%.

Given the low amount of real estate inventory, the strong California economy with lower unemployment and higher wages, and still-very-low mortgage interest rates, it seems clear that 2016 will be another banner year for the Santa Cruz real estate market. If you’ve been waiting for an opportune time to sell your home in Santa Cruz – this may be it!

Please share my newsletter with anyone you think is interested in what’s going on with the Santa Cruz real estate market – just send them the link and they can sign up to receive an e-mail every month when the newsletter is ready. Thanks so much for taking the time to read this – I hope to hear from you soon!