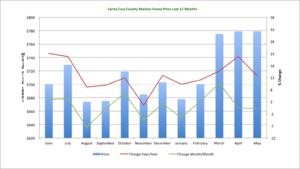

It’s a tie! According to the Santa Cruz Real Estate Update June 2015, the median home price for single family homes in Santa Cruz county in May of 2015 was $779,000. This is exactly the same it was the month before – but it is up 13.7% from May of 2014, when the median price was $685,000.

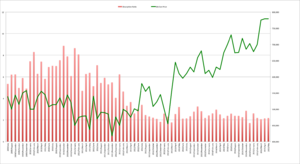

We ended the month with 288 active single-family home listings – an increase of 0.7% from the prior month – but down 42.3% from a year ago, when there were 499 homes available at the end of May 2014. The median price and the level of inventory are two numbers which are interlinked, as you can see on the price versus absorption ratio chart, below:

Look at the past couple of months – April and May 2015, on the far right of the chart. You can see the median home price is the same for those two months. What else is the same? Look down: the absorption ratio is also virtually the same. And look at the month before, in March: the median price then was $775,000, and the absorption ratio was also not much different from today.

There was a huge jump in prices from February to March, which accounts for most of the price increase this year over last year. Since then, prices are not much changed, one way or another. For the past three months, the market has been in a state of near stasis.

I’ve had a lot of conversations just in the past few weeks about the current state of affairs. I’ve heard from a lot of buyers (or would-be buyers!) who are simply floored by what has happened to home prices.

It feels as though we have moved beyond asking if we’re in a real estate bubble. Now, people are wondering how soon until the correction comes. When are prices going to drop, and by how much? The feeling out there – at least anecdotally, in my experience – is that we have passed the point of sustainability, and that something’s got to give.

But what’s it going to take to burst that bubble, and send prices back down to a point where more people can actually afford to buy a home in Santa Cruz?

The last time that home prices collapsed was back in 2007-2008. Back then it was called the sub-prime mortgage crisis, but it wasn’t much more than a year or so before the collapse of the sub-prime mortgage market affected every strata of real estate, and nearly brought down the entire world economy with it. Those were the days, eh folks?

The interesting thing about that crash was that it was actually brought about by rampant real estate speculation itself. Millions of people had been given loans – huge loans – with no demonstrated ability to repay them. That’s what fed the bubble the last time, and the inability to pay those loans – many made with no down payment from the buyer – is what caused the crash.

The situation is very different today. Today’s market is being driven in large part by affordable interest rates, and the fact that rents have skyrocketed. Back in the bad old days, it was common for people to be paying twice as much on a monthly basis to buy rather than to rent. Today the calculus is very different: the majority of buyers I talk to today are interested in buying simply because they don’t want to throw away money on rent. I don’t get the sense people are planning on buying a house, holding onto it for two years, and then selling it for a massive tax-free gain. People are buying today in large part because rental prices have just gotten completely out of control.

There’s no denying that there’s been a huge run-up in prices over the past three years. The reasons for this are pretty clear, and I’ve talked about it in many of my Santa Cruz real estate market updates over the past few years. But it all comes down to this: supply and demand. Demand has gotten stronger as the economy has recovered for the past several years. Even as demand has increased, supply has actually decreased, which has worked to push home prices high.

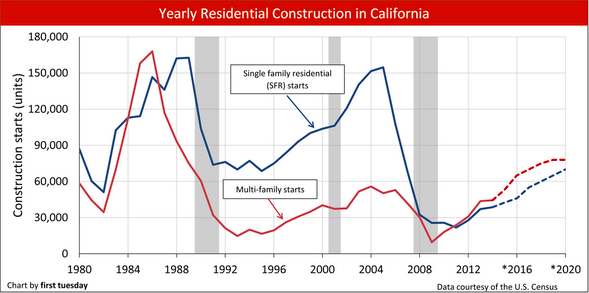

But remember, it’s not just home prices that have been pushed higher: rents have been pushed right up along with housing prices. This points to the fact that there just is not enough housing in the San Francisco and Monterey Bay areas. For an explanation, check out this chart here:

Yearly Residential Construction in California, courtesy of First Tuesday

As you can see, home construction in California is far below peak levels. For example, in 2014 there were just 38,600 housing starts of single family homes for the entire year in the entire state – during a time when the population grew by roughly 330,000 people. True, there were also 44,300 multi-family housing starts in 2014 – but it’s clear to see that the housing stock has not been growing nearly as quickly as the population.

So what’s it going to take to bring housing prices in Santa Cruz back down to a level where more people can afford it? As usual, late-night infomercials supply the answers to even the most deeply rooted angst, as seen in this YouTube clip below:

The answer? Calamity. Ron Paul and Porter Stansberry will tell you that it’s going to be a currency crisis. The value of the dollar will collapse. That’s why you should buy gold, I guess. I’m not quite sure what Porter Stansberry and Ron Paul are peddling, but they’re selling it with liberal helpings of fear, uncertainty, and doubt. Nothing wrong with that, this is America, after all.

What they’re saying though – and they say it openly – is that the economy is going crash, and crash badly – they just can’t say when that’s going to happen, or how, exactly. This is what’s known as a black swan theory – or “the disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology.”

The fact of the matter is, the U.S. economy is prone to crashing. It’s the boom and bust cycle that’s been going on since the founding of the republic, I’m pretty sure. Right now, believe it or not – we’re in a boom time – but for how much longer?

I’m guessing it’s going to go on a while longer yet. What makes me say that? Simple: the fact that interest rates are increasing. Yes, they’ve gone up and down before, and the 30 year fixed mortgage rate still isn’t much above 4%. But the Fed is now talking pretty openly about finally raising interest rates. This is happening because, finally, the prospects for more robust, longer term growth actually appear to be pretty good.

In fact, The Economist magazine recently published a briefing about the state of the U.S. economy entitled Better than it looks. Here are a few tidbits about the state of the economy they detailed:

- The ratio of mortgage debt to GDP has fallen below 80%, back to its 2002 level

- Total household debt is around 107% of disposable income, down from the 2008 peak of 130%

- Annual payments take up less than 10% of disposable income, down from 13.5% in 2009 and the lowest amount since 1980

- Household net worth (total assets minus liabilities) is at a record high in real terms, and is close to its pre-crisis peak as a share of GDP

- Unemployment has fallen to 5.5%

- Year-on-year wage gains increased to 2.3% in June

So things appear to be going OK for now, but when’s the bust coming? What will bring it on? And how bad will it be? This is what hundreds of thousands of would-be California home buyers want to know. And the answer to that is, quite simply: nobody has any idea. Not Ron Paul, not Porter Stansberry, nobody.

Locally, it’s going to happen when Silicon Valley catches a cold. Eventually, profits will sink, layoffs will happen. Growth will shrink and go into reverse. Home prices will fall, but by how far, and for how long, is anybody’s guess.

Long term though? I tell people, hey look: we are in the back yard of one of the very brightest spots in the world economy – certainly, in the U.S. economy. As a life-long Californian, I pray that nobody is actually hoping that Silicon Valley experiences a profound and long-lasting collapse, because I really don’t think that’s going to be good for anyone.

So long as Silicon Valley continues its outsize success, and the jobs, money, and people are attracted to the area – and Santa Cruz – for its many splendors, you can expect that home prices here will continue to be uncomfortably high.

The Rest of the Story

A total of 141 homes closed escrow in May, a drop of 17.5% compared to a year ago. However, this is an increase of 6% as compared to the month before. These 141 homes sold in an average of 50 days on market, up about 4.4% from a year ago when homes took 48 days on average to sell.

Homes sold with an average of 100.5% of asking price – an increase of 1.1% compared to a year ago, when sellers received 99.4% of asking price.

The short sale market in Santa Cruz county is almost dead, with 0 short sales having been sold in the month. Only two bank-owned “REO” foreclosure properties were sold in the entire county this month.

Please share my newsletter with anyone you think is interested in what’s going on with the Santa Cruz real estate market – just send them the link and they can sign up to receive an e-mail every month when the newsletter is ready. Thanks so much for taking the time to read this – I hope to hear from you soon!

–