There has been much digital ink spilled about the landmark settlement recently reached in the matter of the multiple commission lawsuits rocking the real estate industry. This is perhaps the culmination of a process that was long in gestation, and still requires court approval before it might be considered resolved. There’s much that can, should be, has, and will be said about the merits of these lawsuits and the ensuing settlement(s), and I myself may have something to say about this specifically at some later date. But given all the lurid headlines around these lawsuits and the settlement, many people are today asking why a seller should pay a buyer’s agent’s commission – and I will answer that question here for you in this article.

Lost in the sensational headlines surrounding these lawsuits and proposed settlement(s) is one key fact: the commission that the seller pays has always been negotiable. The crux of the lawsuits, however, revolve around blanket offers of compensation from the seller to pay a buyer’s agent, in order for the home to be listed on most multiple listing services. This has been a requirement for as long as I’ve been in real estate (first licensed in 2003, if you’re curious) – and for at least a decade or two prior to that. In other words, most MLS systems required that the listing agent offer at least some compensation to the buyer’s agent if the home was to be listed on the MLS.

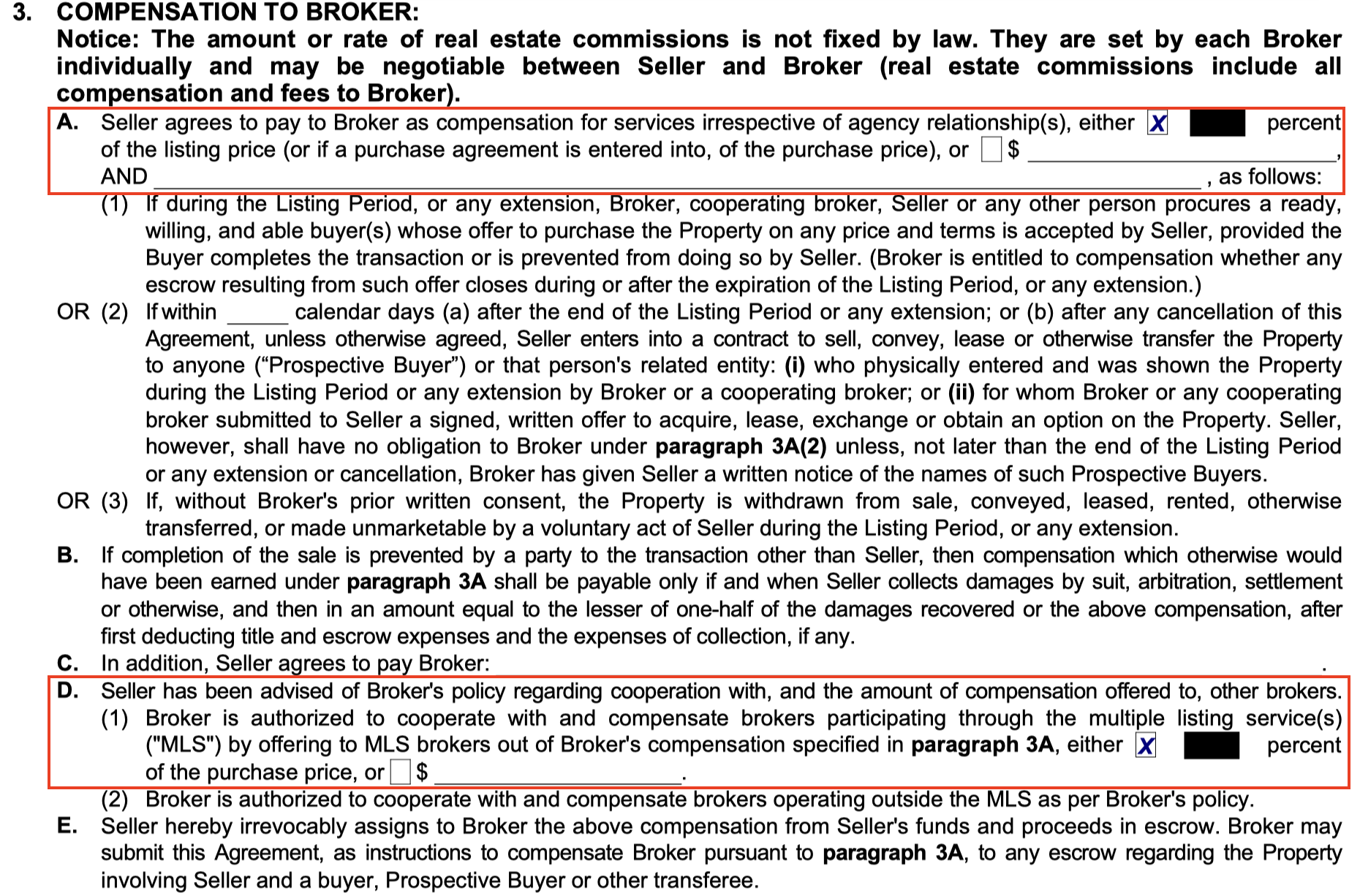

I like to say that this whole “commission lawsuit” is about $1 – because that had been the minimum compensation a listing agent would need to offer a buyer’s broker in order for the listing to be entered into the MLS. This $1 would have come out of the total commission paid to the listing broker. You can see how all this works (or worked) by looking at the California Residential Listing Agreement, in paragraph 3 – specifically, paragraph 3A and paragraph 3C, which are highlighted in red in the screenshot below:

RLA Paragraph 3

Commissions Have Always Been Negotiable in the Bay Area

These lawsuits did not begin in California (although there have been a few “copycat” lawsuits since the original suits were filed). Perhaps the listing agreement in Missouri (where these lawsuits first began) looks substantially different from the California Residential Listing Agreement. But here in the Bay Area, it’s long been the case that the commission is negotiated between the seller and the listing agent, and the seller authorized the agent to share a portion of the total commission with any buyer’s agent.

As is clear from the listing agreement, the seller agrees to pay the listing broker a certain percentage of the sale price (or a fixed dollar amount) if the broker is able to find a buyer and present an offer that the seller accepts and then closes successfully. In Paragraph 3C, the seller then authorizes the listing agent to offer any cooperating broker a portion of the total commission specified in Paragraph 3A. This “cooperating broker compensation” would then be displayed in the MLS, and buyer’s agents would see (and the public can now also see, on may real estate portal sites) how much the seller and the listing broker have agreed to compensate any buyer’s agent.

As a result of these lawsuits and settlement(s), the listing broker will no longer be able to offer any compensation at all to a cooperating broker through the MLS. Mind you, the seller will still be able to pay a buyer’s broker a commission, they just won’t be allowed to advertise that through the MLS as has been true for the past 3-4 decades. As a result of this change in policy, many sellers are asking their brokers why a seller should pay a buyer’s agent’s commission in the Bay Area?

That’s a fair question – but it is not a new question. For decades, each and every time a seller in the Bay Area has filled out the Residential Listing Agreement with the listing agent, they have discussed (negotiated) the total commission, as well as the portion of that, if any, which would be made to a cooperating broker. Previously, a listing broker would have needed to explain that to be listed on the MLS, the seller must agree to let the listing broker offer at least $1 in cooperating compensation for a buyer’s agent.

In point of fact, very very few listings ever offered $1 to a buyer’s broker as compensation. I have seen a handful of these listing over my 20+ years in the business, but I’ve seen quite a few more where the commission offered to a buyer’s agent might be considered “low” – something like $1,000 or $10,000 or perhaps 1%. But most of the time, I’ve seen cooperating broker’s compensation given in the range of 2.0-3.0% of the purchase price.

It is a fact that sellers in the Bay Area have overwhelmingly elected to offer non-trivial amounts of compensation to buyer’s brokers for the past several decades – even though up until now, they’ve really only needed to offer $1 (paid out of the listing agent’s commission) to get their home on the MLS. This begs the question: why has this been essentially standard practice for so long? And, now that sellers can get the same MLS exposure but offer $0 for the buyer’s agent – should sellers continue to offer substantial commission to buyer’s agents, as well as to their own listing agent? To answer that, it’s helpful to understand just what a commission is, and what it does.

What is a Real Estate Commission?

In the real estate industry, a commission serves as a powerful incentive for agents to sell properties. In essence, that’s what a commission is, pure and simple: an incentive to sell. This compensation structure aligns the agent’s financial interests with the seller’s goal of achieving the highest possible sale price within the shortest time frame. Essentially, the commission motivates agents to invest their time, expertise, and resources effectively.

By working on a commission basis, buyer’s agents are incentivized to bring their clients, sell them on the property, negotiate the price and terms of the sale, and facilitate a smooth transaction process. This ensures that they will do everything they can – while maintaining loyalty to their client and being observant of their fiduciary responsibility – to get the deal to the closing table, knowing that their earnings are directly and exclusively tied to the completion of the sale. No sale, no pay – and no cost to the seller. This performance-based reward system fosters a proactive, results-oriented approach among real estate professionals, ultimately benefiting sellers through higher sale prices, fewer very costly cancellations of contract, and quicker sales.

When you’re selling a home, your chief consideration is likely to be not how much you sell it for, but rather, how much you walk away with at closing, after all expenses of the sale are accounted for. There are other considerations, of course: how quickly the home is sold, how much effort it requires on the part of the seller, and of course, the stress of what can be an uncertain process. But the net upon sale – the amount of cash you receive at closing – is usually paramount. Paying a commission is not a zero-sum game; sellers have long chosen to pay these commissions because doing so means they get more at closing, after the commission expense, than if they didn’t agree to pay one.

Benefits of Paying a Commission

As I’ve just explained, a commission is an incentive for an agent to not only find a buyer for your home, but get that buyer into contract on acceptable terms, and bring them along all the way to closing – the moment when the title of your home transfers to that buyer, and you get paid. Here though is a run-down of the benefits of paying a commission on the sale of home in the Bay Area:

- Attract More Buyers: Offering to pay the buyer’s agent’s commission can make your property more appealing to a wider pool of buyers, since most buyers do work with an agent and that agent will need to be paid.

- Faster Sale: By incentivizing buyers’ agents, you may encourage more showings and offers, potentially leading to a faster sale (and time is money!)

- Higher Offers: a buyer’s agent will coach the buyer to make a strong offer that is likely to beat out competing offers.

- Closing Efficiency: an incentivized agent will work to make sure that the deal closes because that’s the only way they will get paid.

- Marketability in Tough Times: In a slow market, offering to pay the buyer’s agent’s commission can make your listing stand out from the competition.

In the competitive real estate market, the strategic use of buyer’s agent commissions can significantly enhance the visibility and attractiveness of your property listing. Offering such commissions incentivizes buyer’s agents to show your home to potential buyers, increasing the likelihood of receiving multiple offers. This approach aligns with industry practices, as most properties listed for sale offer commissions to buyer’s agents. By choosing not to offer a commission, you risk putting your property at a disadvantage compared to others that do, potentially alienating a substantial portion of the market where buyers prefer or rely on agent representation.

Moreover, the benefits of offering a buyer’s agent commission extend beyond simply increasing traffic to your listing. It opens your property to a wider audience, particularly to those buyers who are not in a position, feel they are unable, to pay agent fees out of pocket. Since buyers typically finance only the purchase price of the home and not the agent’s fee, listings that do not offer commissions might deter a significant portion of potential buyers. This reduction in prospective buyers can ultimately impact the final sale price negatively. While it is not mandatory to offer a commission, doing so is a sound strategy to maximize exposure and attract the best offers, thereby enhancing the likelihood of a successful sale. As your real estate broker, part of my fiduciary duty is to ensure your listing receives optimal exposure and achieves competitive offers, which is why I strongly encourage all sellers to offer to pay a buyer’s agent’s commission.

How a Buyer’s Agent helps the Seller get More Money

Although it might seem counterintuitive, a buyer’s agent does indeed play a crucial role in helping a seller achieve a better price and more favorable terms for their property. Contrary to popular belief, buyer’s agents rarely work against the seller’s interests. In almost all cases, the buyer’s agent is doing work that is totally in alignment with the seller’s goals – selling fast, at a high price, and constantly moving the deal past the various milestones to the closing table.

The buyer’s agent’s goals are almost wholly in alignment with the seller’s goals – assuming that both the seller and the buyer are working in good faith and that all material facts have been properly disclosed prior to making an offer on the home. If these things are true – and they should always be true – the buyer’s agent and the seller will not truly be at odds – they will be working together to meet a mutually desired goal.

Many sellers labor under the misapprehension that the buyer’s agent’s objective is to get the buyer a great price – which requires that you, the seller, cut your price and agree to easy terms for the buyer to boot. However, in the Bay Area, if you have properly priced your home for sale you can reasonably expect that you will have a bidding war on your hands. In this very-common scenario, the buyer’s agent’s goal is actually to convince the buyer to offer more, and with the best possible terms for the seller. That’s right: the buyer’s agent is coaching the buyer how to make an offer that will get you, the seller, the best price and terms. While the listing agent should be doing the very same thing, the buyer’s agent is the person who typically has much more of a trusting relationship with that buyer, and so they are the most effective person to do this very important job.

And even when you don’t have multiple offers and a bidding war on your home, the buyer’s agent is still usually working to bring you a higher offer. They will prove to the buyer that a low-ball offer is often counter-productive. They will explain that even if theirs is the only offer on the table, the buyer is not operating in a vacuum – there are market forces, there are other buyers out there. The buyer’s agent will be coaching the buyer to bring an offer that the seller is likely to find acceptable – and, once the offer is accepted, will be working to make sure the buyer holds up their end of the deal and that the sale closes in a timely manner at the agreed upon price and terms.

Buyer’s Agents Provide an Element of Trust

The success of a real estate transaction ultimately rests on trust: buyers and sellers trust each other to operate in good faith and fulfill the terms of the agreement in the time stipulated in the contract. A buyer who does not have an agent will rarely understand how a purchase contract works and what is incumbent upon them to successfully bring the transaction to a close. The listing agent and the seller will trust the buyer’s agent to make sure the buyer performs as required, and the buyer’s agent is strongly incentivized through that commission to make sure the buyer does just that.

It is helpful when the listing agent already knows and trusts the buyer’s agent. Of course, in a marketplace with thousands of agents, it is very common that agents will not know each other personally. However, even here, there is a web of trust: an agent can review another agent’s license, past transactions and Zillow reviews to get comfortable with that agent’s track record. The agent may well be familiar with the buyer’s agent’s broker or brokerage, and establish a trusted connection through them. And, last but not least, both agents are likely members of the National Association of REALTORS and are thus bound to accept and operate by the well-known and well-regarded Code of Ethics.

Trust between agents in real estate transactions is a fundamental element that facilitates smoother deals, enhances communication, and significantly reduces the likelihood of cancellations. This trust is built on professional integrity, transparent communication, and mutual respect, and it impacts the transaction process in several key ways:

- Strong Communication: When agents trust each other, they communicate more openly and efficiently. This directness ensures that both parties are informed about the progress and any issues that may arise, allowing for quick resolutions and minimizing misunderstandings that could lead to cancellations.

- Effective Negotiation: Trust fosters a more collaborative environment for negotiation. Agents are more likely to work together to find mutually beneficial solutions for their clients, rather than adopting adversarial positions. This cooperation can lead to agreements that satisfy all parties involved, thereby reducing the risk of deals falling through.

- Smooth Transaction Process: Trust between agents leads to a smoother transaction process. Each agent can rely on the other to fulfill their responsibilities promptly and accurately, from adhering to timelines to ensuring all paperwork is in order. This reliability helps prevent delays and keeps the transaction moving forward.

- Problem Solving: In every real estate transaction, issues can arise, whether they’re related to inspections, appraisals, financing, or other unforeseen circumstances. When agents trust each other, they’re more likely to work together constructively to solve these problems instead of letting them derail the sale.

- Professional Reputation: Agents who are known to be trustworthy and reliable often have strong professional reputations. This reputation precedes them in negotiations and dealings, making other agents more willing to enter into transactions with them, confident in the knowledge that the process will be as smooth and straightforward as possible.

- Reduced Stress for Clients: The trust between agents can significantly reduce the stress levels for both buyers and sellers. Knowing that their agents are working well together to navigate the complexities of the transaction provides peace of mind, which is crucial for keeping both parties engaged and committed to the process.

Trust between real estate agents not only enhances the efficiency and effectiveness of individual transactions but also contributes to a more professional and cooperative industry overall. This foundation of trust is vital for reducing cancellations and ensuring that transactions progress to a successful conclusion, benefiting agents, buyers, and sellers alike.

Paying a Buyer’s Agent is Money Well Spent

With the recent changes in the way that buyer’s agents may be paid in the future, it’s unsurprising that sellers are asking how and why buyer’s agents should be compensated. As this article has made clear, sellers have always had the choice to pay – or not to pay – a buyer’s agent’s commission, decades before these latest changes to the system. Sellers have long chosen to pay buyer’s agents, because there have always been very good reasons to do so – and these fundamental reasons have not changed. A wise seller who is interested in selling at the highest price and with the best terms possible will continue to offer competitive compensation to a buyer’s agent.

Silicon Valley Luxury Homes for Sale

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25