In the labyrinth of real estate transactions, the concept of price per square foot plays a pivotal role. But its interpretation and application are often replete with misconceptions and misinterpretations. Read this article to understand why larger homes sell for less per square foot, especially in the greater Bay Area.

The Square Foot Pricing Puzzle

Before delving into the depths of square foot pricing, it’s crucial to comprehend what it represents. The price per square foot is a common measure in the Bay Area real estate market used to compare the value of different (but perhaps otherwise similar) properties. However, its application is far from straightforward and often leads to skewed perceptions about property value. In fact, the square footage of a home is only one of a number of factors that appraisers use to value properties – and it is far from the most important.

The Oversimplified Equation

A common error lies in the simplification of the price per square foot equation. It’s often misconstrued that a larger property will naturally fetch a linearly higher price. However, the reality is far from this assumption. A larger home does not necessarily equate to a higher per-square-foot price. In fact, in many cases, homes with a larger square footage sell for significantly less on a per-square-foot basis than “average” sized homes in the Bay Area real estate market.

The Misconception of Equal Value

A prevalent misconception is the belief in a uniform price per square foot across a neighborhood. However, real estate markets are dynamic, and property prices can vary widely even within the same locality. Factors such as location, property condition, upgrade quality, and lot size, among others, can significantly influence the price per square foot.

The Paradox of Larger Homes: Decreasing Value per Square Foot

An intriguing aspect of the price per square foot calculation is the apparent paradox that emerges with larger properties. Surprisingly, as the size of a property increases, the price per square foot tends to decrease. This decrease is a classic example of the law of diminishing returns or economy of scale.

The Land-Structure Value Ratio

Understanding the decline in value per square foot with larger properties requires a comprehension of the land-structure value ratio. A property’s value is the sum of the land value and the structure value. When a structure is enlarged, the land value remains fixed, resulting in a slower rate of value increase for the property compared to the rate of size increase. Consequently, the price per square foot must decrease as size increases.

The Empirical Evidence

Real estate data provides empirical evidence of this paradoxical relationship. A data-driven analysis of property sales reveals a clear correlation between an increase in property size and a decrease in price per square foot. This trend underscores the risk of using price per square foot as the sole determinant of property value.

The Fallacies of Square Foot Pricing

Square foot pricing, despite its ubiquity, can be fraught with dangers if misused or misunderstood. Here are some key fallacies to watch out for:

The “Average” Trap

The average price per square foot is another misleading measure often used in real estate. While it offers a broad overview, it fails to consider the wide spectrum of property characteristics and conditions. Therefore, relying solely on an average figure to value a property will almost invariably lead to inaccurate conclusions about the total property value.

The Median Misstep

The median price per square foot, which denotes the middle value in a range of prices, is another commonly used yet potentially deceptive measure. Although considered a more accurate measure of value than the average, it too falls short in providing a comprehensive picture of property value.

How Appraisers Adjust for Price per Square Foot in the Bay Area

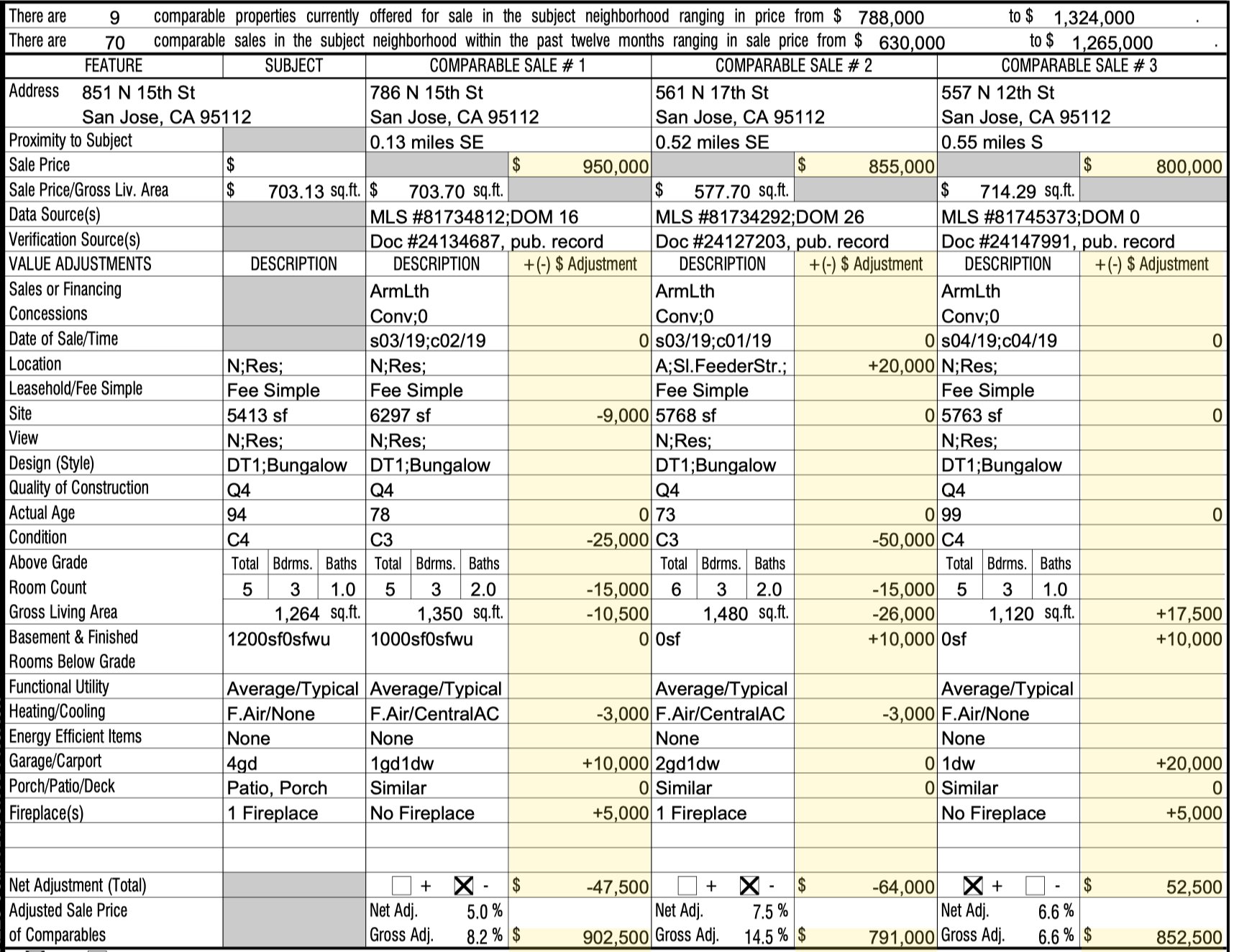

Many homeowners use the size of their home versus the size of recently sold, smaller properties in the neighborhood to claim that their homes must be worth substantially more than these recent, smaller, but otherwise comparable sales. To better understand the way that appraisers look at this question, it is helpful to examine the sales comparison grid that appraisers use when determining fair market value for a home. An example of the sales comparison grid is below:

Appraisal Adjustments URAR Form 1004

In this appraisal, the subject property is 1,264 square feet, and in the upper left corner of the grid you can see that the appraiser notes the sale price per gross square foot of living area is $703.13. The price-per-square-foot of the comparables is $703.70, $577.70, and $714.29 respectively.

Here are the comparable properties their difference in square footage, the total adjustment made for that square footage, and the total price per square foot of each adjustment:

- Comparable 1: Difference in Square Footage: 86 / Total Adjustment: $10,500 / Adjusted Price per Sq. Ft. : $122.09

- Comparable 2: Difference in Square Footage: 216 / Total Adjustment: $26,000 / Adjusted Price per Sq. Ft. : $120.37

- Comparable 2: Difference in Square Footage: 144 / Total Adjustment: $17,500 / Adjusted Price per Sq. Ft. : $121.52

As you can see, the average adjustment made per square foot in this example is nowhere near the average price per square foot of either the subject property or the comparables. The average price per square foot of the comparables is $665, but the average price per square foot of the adjustments is only about $121 – or only about 18% of the price per square foot. That is far less than most homeowners expect their “extra” square footage may be worth.

The Principal of Regression

The principle of regression in real estate refers to the tendency of the price per square foot of larger-than-average homes to be lower than that of smaller or average-sized homes in the same neighborhood. Larger homes often appeal to a smaller buyer pool due to their higher overall cost, and the incremental value of added space decreases. Thus, while the total price of a larger home is generally higher, the cost per square foot will not usually scale up linearly, leading to a lower price per square foot compared to smaller homes. This principle is important for understanding market dynamics, especially in areas like the Bay Area and Silicon Valley where property values and buyer preferences can vary widely.

The Cost of Updating a Larger Home

Older, larger homes often face challenges in commanding a high price per square foot, primarily due to the increased costs associated with updating and maintaining them. These homes, while spacious and potentially rich in character, often require significant investment to bring them up to modern standards, both in terms of aesthetics and functionality.

For instance, updating an older, larger home may involve extensive electrical, plumbing, and structural work, which can be disproportionately expensive compared to smaller homes. Additionally, the cost of modernizing finishes, fixtures, and appliances in a larger space adds up quickly.

Buyers considering these properties are likely to factor in these potential renovation costs, which will usually lead them to offer a lower price per square foot compared to smaller, more recently updated homes. This is particularly relevant in areas like the Bay Area and Silicon Valley, where the real estate market is competitive and buyer expectations are high.

The Art of Pricing: Beyond Square Footage

Given the complexities and paradoxes surrounding square foot pricing, it’s essential to adopt a holistic approach when valuing properties.

The “Apples to Apples” Approach

Instead of using the price per square foot as the primary determinant of property value, it’s advisable to adopt an “apples to apples” approach. This method involves comparing similar properties based on size, location, condition, and other relevant factors. It allows for a more accurate and realistic valuation of a property. This is also called the “sales comparison” approach to home appraisal, and is the most common method of appraisal in the Bay Area.

The Importance of Trends

While average or median per-square-foot costs may not provide an accurate measure of a property’s value, they can offer valuable insights into market trends. By comparing the average price per square foot over time, we can discern whether property values are rising or falling.

The Bottom Line

In the intricate world of Bay Area real estate, the price per square foot serves as a helpful tool but not a definitive guide. It’s a metric that demands careful interpretation and cautious application. Understanding its limitations and fallacies can help property buyers, sellers, and appraisers navigate the real estate market more effectively and make informed decisions.